—–

Top News in the A.M.

Andreessen Horowitz has just made a giant bet on bitcoin, leading a $25 million investment in a San Francisco-based company that makes it easier to buy and sell the digital currency. (See also in Fund News below.)

—–

Focusing on Privacy Issues, Before the Sale

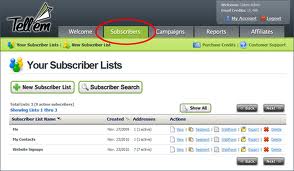

Earlier this week, The Recorder observed that maintaining strong privacy standards is now a serious requirement for startups interested in M&A, not some “item on a deal-making checklist or a vague commitment to users.” Since the biggest asset of many startups is often data like subscriber lists, neglecting privacy standards can be a deal-killer, the outlet observed.

Surprisingly (to me), one attorney told The Recorder of the issue: “Only a tiny minority of companies really have their act together; a good number of companies are completely out to lunch.”

To find out more about how big a sticking issue privacy has become for acquirers, I talked yesterday with Christine Lyon, an attorney at Morrison Foerster who focuses on privacy and employment law.

Lyon told me that a big part of the shift owes to increased regulatory scrutiny, saying the Federal Trade Commission “has been more active in privacy enforcement generally.”

I asked Lyon who tends to be the most “at risk.” She cited mobile app makers, largely because “they might not think of themselves as collecting personal information, when they are.” (Names and email addresses are considered Personally Identifiable Information, or PII.)

Sometimes, she said, it’s simply a case of “delayed compliance. The [mobile app] startup thinks, ‘Once we’re up and running and have more money, we’ll roll out a policy.’” Unfortunately, says Lyon, “at that point, you’ve collected data, and you’re sort of stuck figuring out how to implement [a privacy policy belatedly].”

Perhaps unsurprisingly, Lyon also mentioned that two other types of companies that should pay special attention to new state and federal privacy laws are sites that either cater in some way to children or deal with health-related information. When it comes to both, the risk of a misstep is much higher, said Lyon — not to mention that buyers in both cases are always “very interested in what sorts of consents were obtained.”

To correct what the FTC would consider a material issue in their privacy policies, a startup can do a couple of things. First, it can try getting the consent of its users retroactively, though most users won’t give it. (Who wants to be bothered?) Another option is to offer users the opportunity to “opt-out” from permitting a company to transfer its data to an acquirer.

Unfortunately, neither solution may be enough to appease a potential acquirer in the current environment. “An area that’s high risk for enforcement will get buyers’ attention,” she’d told me. “We’re just seeing a lot more issues like this cropping up and sometimes killing deals.”

The lesson here is obvious: companies that skimp on privacy could ultimately end up leaving a lot of money on the table.

New Fundings

Bluenose Analytics, a year-old, San Francisco-based enterprise software analytics service focused on keeping its clients’ customers happy, has raised $10 million. Norwest Venture Partners led the round, which included Social+Capital Partnership.

Coinbase, an 18-month-old, San Francisco-based company that makes it easier for users to create a bitcoin wallet and begin buying and selling the digital currency, has raised $25 million in a Series B round led byAndreessen Horowitz. Existing investors Union Square Ventures andRibbit Capital also participated in the round, which brings Coinbase’s total funding to $32 million.

InVitae, a two-year-old, San Francisco-based genetic diagnostics company that develops tests for hereditary disorders, has raised $40 million in Series E financing. Genomic Health, Randy Scott, Thomas McNerney & Partners, Redmile Group, Genesys Capital and Casdin Capital participated in the funding. According to Crunchbase, the compny has now raised nearly $72 million altogether.

MomentFeed, a 3.5-year-old, Santa Monica, Calif.-based location-based marketing platform, has raised $5.5 million led by Signia Venture Partners, with previous investors Draper Nexus, DFJ Frontier, Double M Partners, and Daher Capital also participating.

The Orange Chef, a 2.5-year-old, San Francisco-based company behind a “smart food scale” that communicates nutritional data to users’ iPads, has raised $1.2 million in seed funding led by Google Ventures and Spark Labs. Bertelsmann Digital Media Investments,Kima Ventures, The Social+Capital Partnership, Graph Venturesand angel investors also participated in round, which reportedly remains open to further investment.

Ooyala, the six-year-old, Mountain View, Calif.-based company has raised $43 million in new funding from the Australian telco Telstra. The round brings its total funding to date to $122 million.

Shopify, an eight-year-old, Ottawa, Ontario-based technology company that fuels the online stores of more than 80,000 retailers around the world, has raised $100 million led by OMERS Ventures andInsight Venture Partners. Other participants in the financing includeBessemer Venture Partners, FirstMark Capital, Georgian Partners, and Felicis Ventures. The company has now raised $122 million altogether. The WSJ has much more here, including details about Shopify’s plans to grow online — and its offline — retail business.

Snapchat, the two-year-old, L.A-based company behind one of the hottest messaging apps on the market, has raised $50 million in Series C funding from the hedge fund Coatue Management. Business Insider has more on the low-flying investor here.

UlEvolution, a 13-year-old, Kirkland, Wash.-based software company that helps customers like Toyota reach consumers with everything from their mobile apps to digital signage, has closed $8 million in funding.Intel Capital led the round with participation from Shaw Ventures.

VIPtela, a new, San Jose, Calif.-based still-stealth networking startup, has raised $4 million from Sequoia Capital, reports AllThingsD. The company’s founders come from Juniper Networks and Cisco Systems.

XL Hybrids, a five-year-old, Boston-based maker of low-cost hybrid electric powertrains designed for commercial fleet vehicles, has raised $3 million in a pre-Series C debt financing round from WindSail Capital Group.

—–

People

A spat played out in Boston yesterday between Boston’s startup community and organizers of a startup conference that charged $1,095 for attendees to hear tips from venture capitalists. According to the Boston Globe, some regional VCs and angel investors were so incensed by the high price of the event, they held a free eventsimultaneously yesterday — at no cost to attendees.

General Partner Bing Gordon of Kleiner Perkins Caufield & Byers is becoming the firm’s first “chief product officer,” leading a university-like program for Kleiner founders called KPCB ProductWorks. As a result, Gordon told reporters yesterday, he’ll be scaling back his board involvements.

—–

Ebates Shopping.com, a 15-year-old, San Francisco-based online coupon company, is planning to go public next year and has already picked JPMorgan Chase to lead its offering, says Bloomberg. According to eMarketer, 100 million U.S. adults will use digital coupons in 2014, up from 96.6 million this year.

Zoosk, a six-year-old, San Francisco-based company behind a popular online-dating service, is also eyeing a 2014 IPO, reports Bloomberg, which says the company has already picked Bank of America to lead the offering, along with Citigroup and Royal Bank of Canada.

—–

Exits

Carrot Creative, an eight-year-old, New York-based digital agency that creates apps, websites games for media companies and brands, has been acquired by the growing media conglomerate Vice Media, reports the New York Times. A person familiar with the acquisition said the deal was valued at $15 million to $20 million in stock and cash.

Evenly, a year-old, San Francisco-based startup whose online payment app was designed to allow users to easily split transactions (like dinner), has been acquired by the mobile payments company Square.Terms of the deal were not disclosed but Evenly’s service will be shut down next month.

Xlogics Group, a Rheinbach, Germany-based “intelligent shipping company” has been acquired by the similar, 14-year-old companyMetaPack, which has offices in London and Hamburg. Terms of the deal weren’t disclosed. MetaPack is venture-backed by Index Ventures, Cross Atlantic Capital Partners and Brainspark.

—–

Happenings

Harvard is hosting its Conference on Web and Internet Economicsthrough Saturday in Cambridge. You can learn more here.

The Le Web Paris conference winds up today. You can find video of the event here.

—–

Data

Japan now spends more on mobile apps than any other country.

—–

Essential Reads

In troubling news for Udacity and its ilk, a study of a million users of massive open online courses by the University of Pennsylvania Graduate School of Education has found that, on average, only about half of those who registered for a course ever viewed a lecture, and only about 4 percent completed the courses.

From this weekend’s New York Times Magazine: Some day, “Your house keys will tell you that they’re still on your desk at work. Your tools will remind you that they were lent to a friend. And your car will be able to drive itself on an errand to retrieve both your keys and your tools.” Its a future in which are maps are required and Google, naturally, plans to dominate that future.

—–

Detours

Yikes. The U.S. government lobotomized at least 2,000 mentally ill veterans during and after World War II, according to forgotten memos, letters and government reports unearthed by The Wall Street Journal.

The first documentary on cult-favorite Sriracha hot sauce is available for download.

—–

Retail Therapy

Fun with motorcycle helmets!

This holiday season, do not buy her the ex-boyfriend revenge kit, which costs a fortune and includes knuckledusters, a crowbar, and a single dose of — wait, what? — sodium amytal?! We’re no retailing experts, but if you have to alert customers that “not all the items in the kit are able to be legally sold in all countries and may require permits,” maybe it’s not such a great gag gift after all.

—–

Please feel free to send us any and all story suggestions (anonymous or otherwise) by clicking here. If you’re interested in advertising in our email newsletter, please click here. To sign up for this newsletter, please click here.